Making the most of your money when paying for college

By Claire Alongi,

BlueDevilHUB.com Staff–

Spring has sprung, and so have college acceptance letters. With the May 1 deposit deadline for most colleges and universities fast approaching, many high school seniors have big decisions to make. But while some may only be considering which institute of higher learning has the programs they’re interested in or the best shopping and transit close to campus, others have bigger roadblocks to consider.

For some seniora, it all comes down to the money and what colleges, if any, they can afford. In some cases, with no reasonable price tags in sight, students might be asking themselves one question: what now?

College costs have been steadily climbing for years. The cost of attending the 2016-2017 year at UC Davis is $61,685 for out-of-state students and $35,003 for in-state students living on campus according to the university’s website. University of Southern California has their cost set at $72,273, also according to their website.

For perspective, the United States Census Bureau lists the median income for households in California for the year 2015 as $61,818. Schools do offer financial aid, but even that may not be enough, even for families that might be reasonably well off.

Robert Farrington, creator of a financing site for millennials called The College Investor, notes in a piece for Forbes that the growing middle class has become part of a group that is “too poor for college, too rich for financial aid.”

While prospective college students and their families do fill out the FAFSA (Free Application for Federal Student Aid), Farrington states “this formula [for the FAFSA] doesn’t take into consideration your family expenses, your needs for saving for retirement and possibly the costs of saving for your other kid’s college education.”

But, there are other options for paying for schools that may seem out of reach.

Some may want to take out student loans. However, while student loans might seem like the best option in the short run, they have quite a high price later on.

In a piece for Money Magazine online, author Denna Ross Higgins explained, “By the time I finish paying off my student loans, my one-year-old twin boys will be starting college.” According to the U.S. Federal Reserve website the total national student debt as of 2016 comes in at 1.4 trillion dollars.

Besides getting loans, students can also appeal for more financial aid. The procedure for this is similar at many schools and will only help if your family’s financial status has changed in some way since originally filing the FAFSA. For example, the UC Davis website lists unemployment, disability, retirement, death or divorce as some instances that might constitute a “special circumstance” that would merit a revaluation of financial aid.

Career Center head Julie Clayton recommends reaching out to colleges to learn about their specific policies regarding financial aid.

“Many colleges are willing to work with students to help them pay for school. Students should start by calling the financial aid office at their college and ask what options there are for getting more financial aid, college scholarships, grants, or part time work,” Clayton said.

Another option is applying for private scholarships. Colleges may have information about private scholarships, or students can investigate scholarship databases like fastweb.com. There may also be local scholarships available. At DHS seniors can check out the Career Center (open 8 a.m. to 4 p.m.) for more information about state and local scholarships.

And, finally, students may choose to take a gap year and defer. Typically students will still need to send in an enrollment deposit, but instead of attending college that coming fall, they will go the following fall. This might be a good option for some students who want to save up money by staying at home and working to save money.

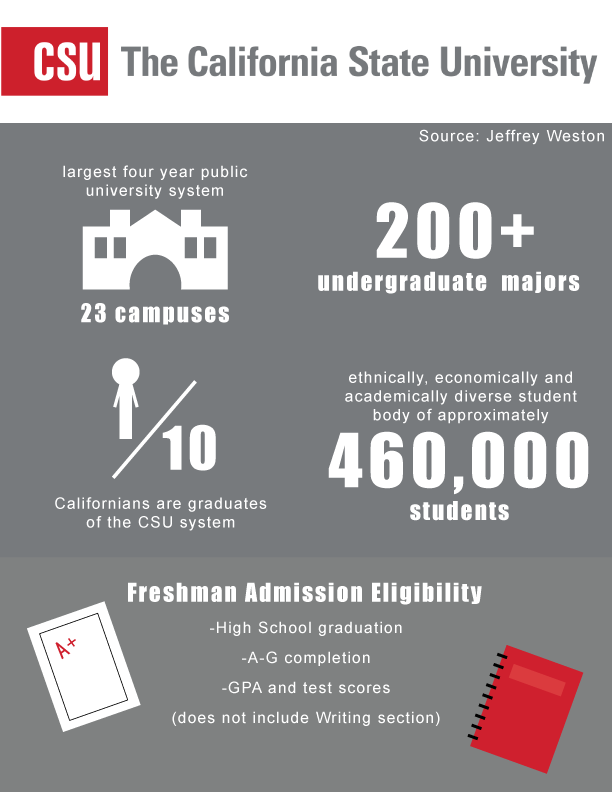

On another note, if students are concerned about money during the application process, they can apply to community college which Clayton describes as “an affordable option for students.”

In the end Clayton suggests that“students should apply broadly to all colleges they’re interested in” and to not give up hope. She notes that expensive colleges may surprise students by offering them more aid than they might expect.